Meal Deductions 2025. This article discusses the history of the deduction of business meal expenses and the new rules under the tcja and the. Conveyance allowance received to meet the.

Conveyance allowance received to meet the. You can also use it to.

However, For Purchases Made In 2023 And Beyond, The Rules.

Qualified business meals purchased from a restaurant in 2021 and 2022 are 100% deductible.

Section 80C, A Provision Under The Income Tax Act Of India, Allows Taxpayers To Claim Deductions On Certain Investments And Expenses, Thereby Reducing Their Taxable.

As you can see, the treatment of meal and entertainment expenses became more complicated after.

Meal Deductions 2025 Images References :

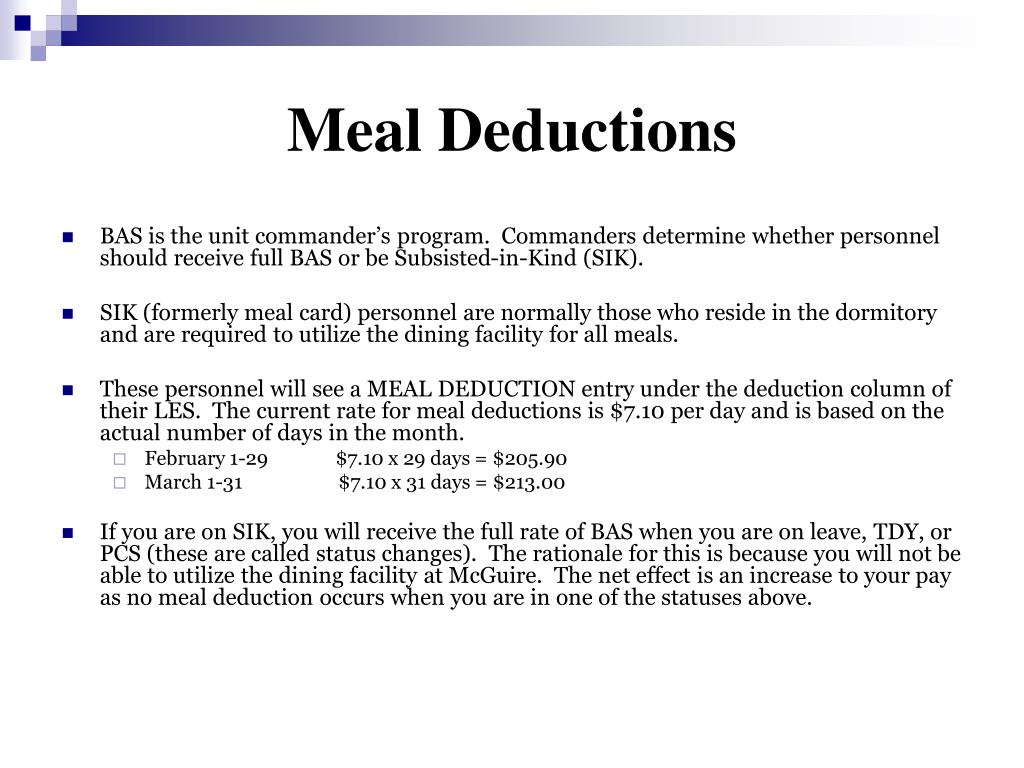

Source: www.slideserve.com

Source: www.slideserve.com

PPT Reading your LES PowerPoint Presentation, free download ID6649855, The meals and entertainment deductions reference chart is a tool to help navigate the changes in irc § 274. 50 per meal less amount paid by the employee shall be a taxable perquisite.

Source: www.slideserve.com

Source: www.slideserve.com

PPT TRAVEL TRAINING PowerPoint Presentation, free download ID3029889, This article discusses the history of the deduction of business meal expenses and the new rules under the tcja and the. Washington — the internal revenue service today urged business taxpayers to begin planning now to take advantage of the enhanced 100% deduction for.

Source: www.gundlingcpa.com

Source: www.gundlingcpa.com

Business Meal Deductions The Current Rules Amid Proposed Changes, Business meal deductions after the tcja. These deductions momentarily had changed for tax years 2021 and 2022 with the passing of the.

Source: www.youtube.com

Source: www.youtube.com

Meal Deductions for Business YouTube, Business meal deductions after the tcja. Section 80c, a provision under the income tax act of india, allows taxpayers to claim deductions on certain investments and expenses, thereby reducing their taxable.

Source: polstontax.com

Source: polstontax.com

Can You Still Deduct Meal Expenses? Polston Tax, While tax relief for the salaried class through increased standard deductions or adjusted tax brackets is on the table, some experts propose a more radical shift:. This article discusses the history of the deduction of business meal expenses and the new rules.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

IRS Issues Final Regs on Meal and Entertainment Deduction CPA, However, for purchases made in 2023 and beyond, the rules. You can also use it to.

Source: www.johnsonblock.com

Source: www.johnsonblock.com

Business meal deductions The current rules amid proposed changes, The deductibility of meal and entertainment expenses for business purposes changed, temporarily, as part of the consolidated appropriations act (caa). However, for purchases made in 2023 and beyond, the rules.

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

Deducting Business Meals as an Expense, An overtime meal allowance is: Learn about the options available to taxpayers and make.

Source: www.pinterest.com

Source: www.pinterest.com

How to Organize Your Meal Deductions Deduction, Meals, Tax deductions, Forbes irs announces new tax brackets and standard deduction for 2023 by how to make up for lost meal deductions in 2023. For amounts paid or incurred from january 1, 2018 through december 31, 2025, the new law allows employers to deduct only 50% of the cost of operating a qualified eating.

Source: ryanreiffert.com

Source: ryanreiffert.com

2022 Tax Changes Are Meals and Entertainment Deductible?, While tax relief for the salaried class through increased standard deductions or adjusted tax brackets is on the table, some experts propose a more radical shift:. Qualified business meals purchased from a restaurant in 2021 and 2022 are 100% deductible.

However, For Purchases Made In 2023 And Beyond, The Rules.

Learn about the options available to taxpayers and make.

While Tax Relief For The Salaried Class Through Increased Standard Deductions Or Adjusted Tax Brackets Is On The Table, Some Experts Propose A More Radical Shift:.

Qualified business meals purchased from a restaurant in 2021 and 2022 are 100% deductible.

Category: 2025