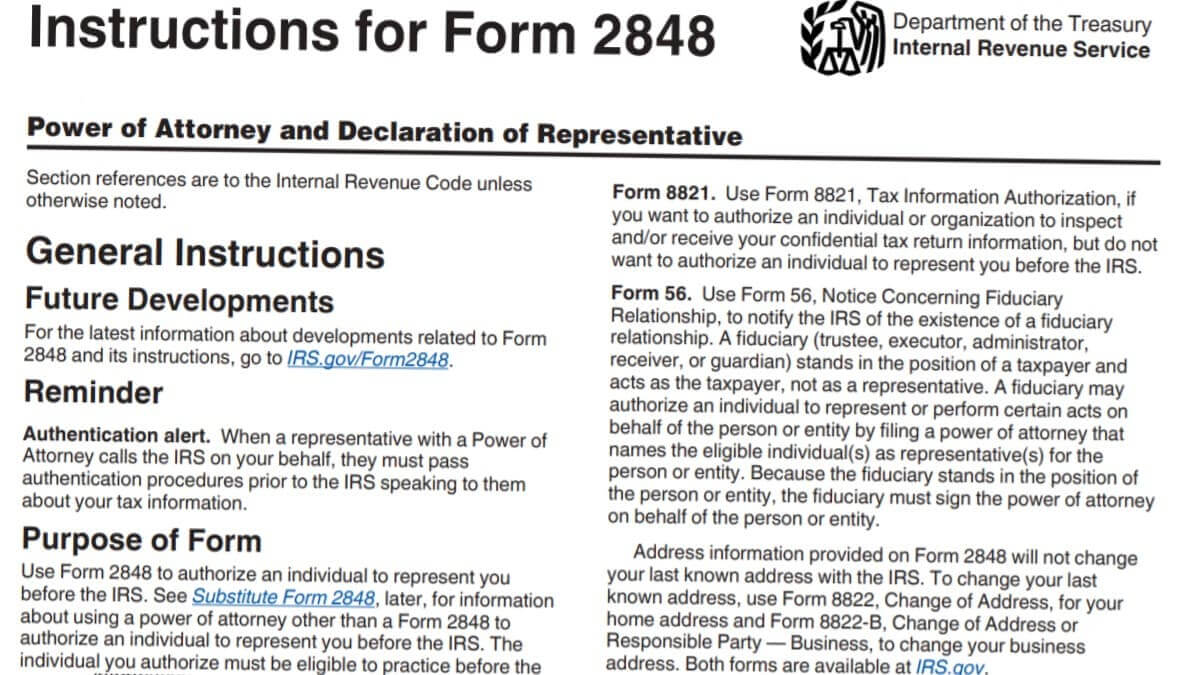

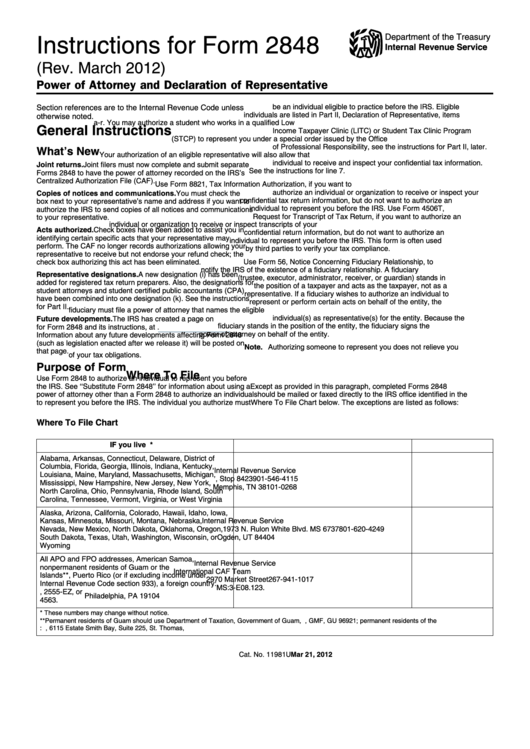

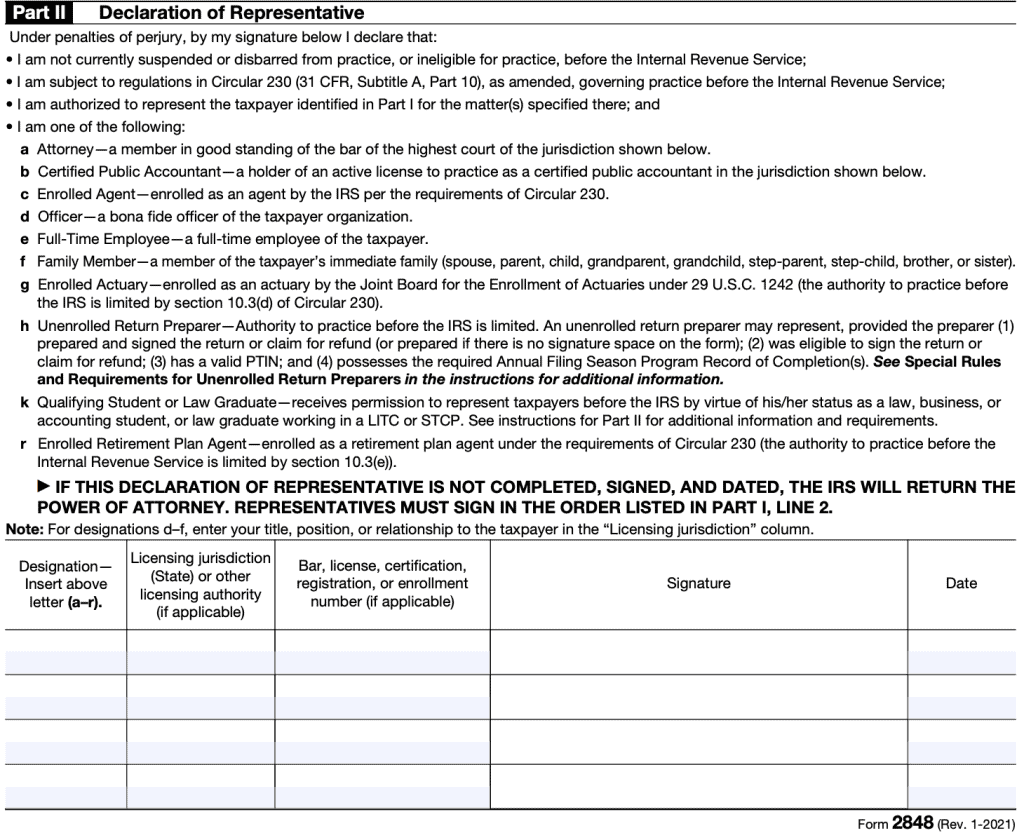

Form 2848 Instructions 2024. If your parent is no longer competent and you are your parent’s power of. What is irs form 2848:

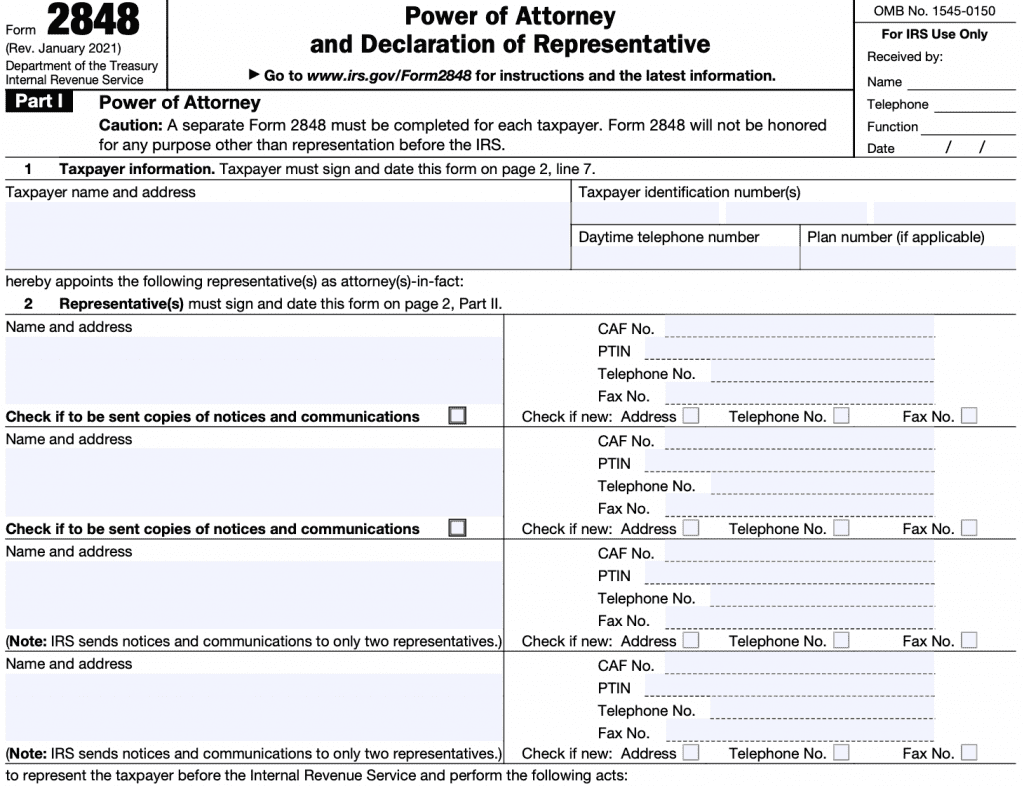

The form and its instructions are available at:. Form 2848 allows tax professionals, such as an attorney, cpa or enrolled agent, to represent clients before the irs as if they were the taxpayer.

Form 2848 Allows Tax Professionals, Such As An Attorney, Cpa Or Enrolled Agent, To Represent Clients Before The Irs As If They Were The Taxpayer.

Form 2848 allows taxpayers to name someone to represent them before the irs.

This Is Similar To The Limited Power Of Attorney You.

Washington ― the internal revenue service announced today that almost 940,000 people across the nation have unclaimed refunds.

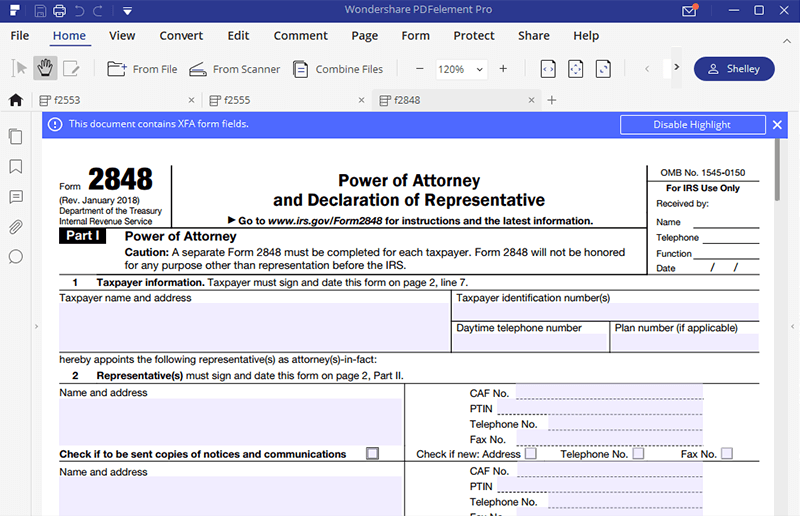

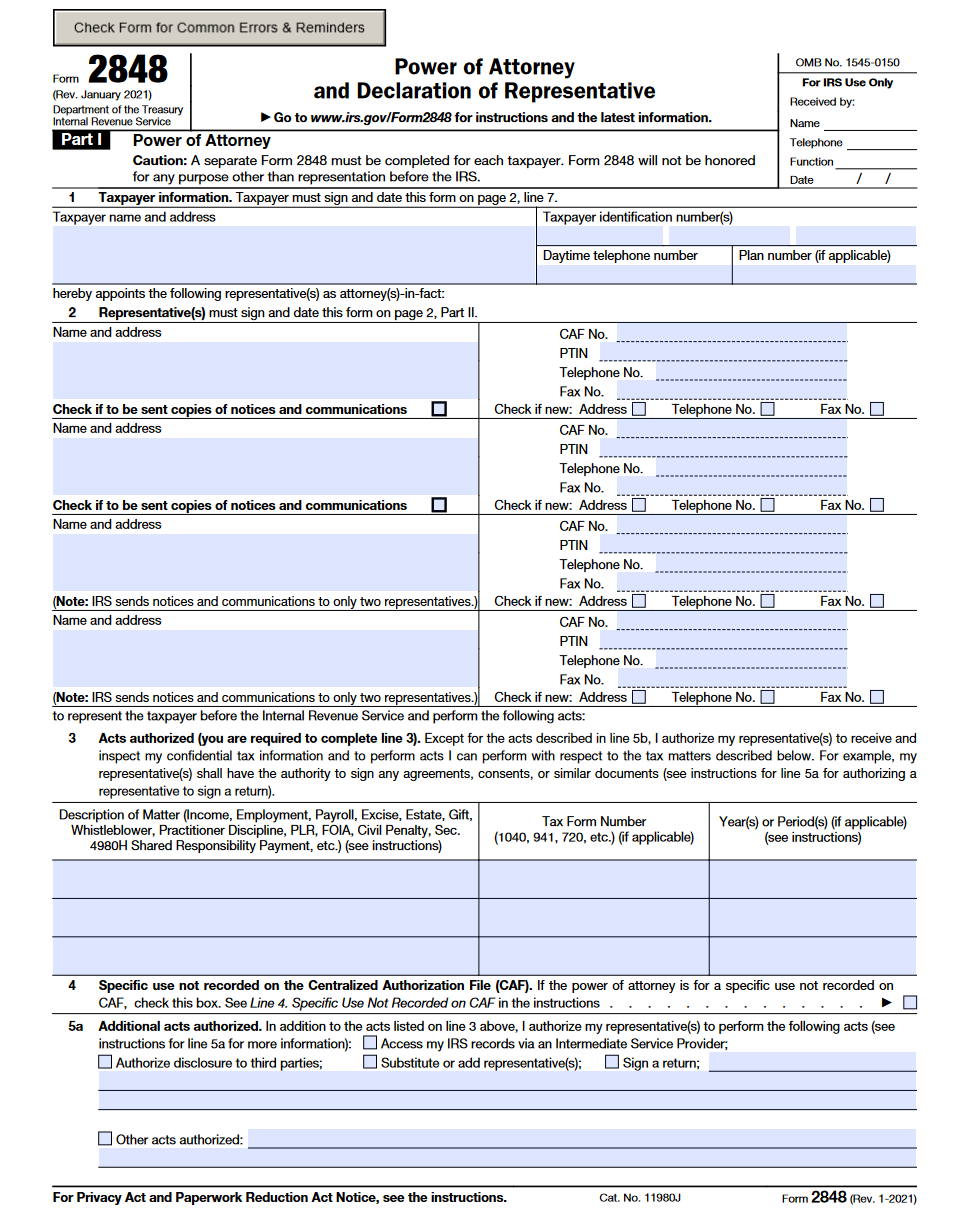

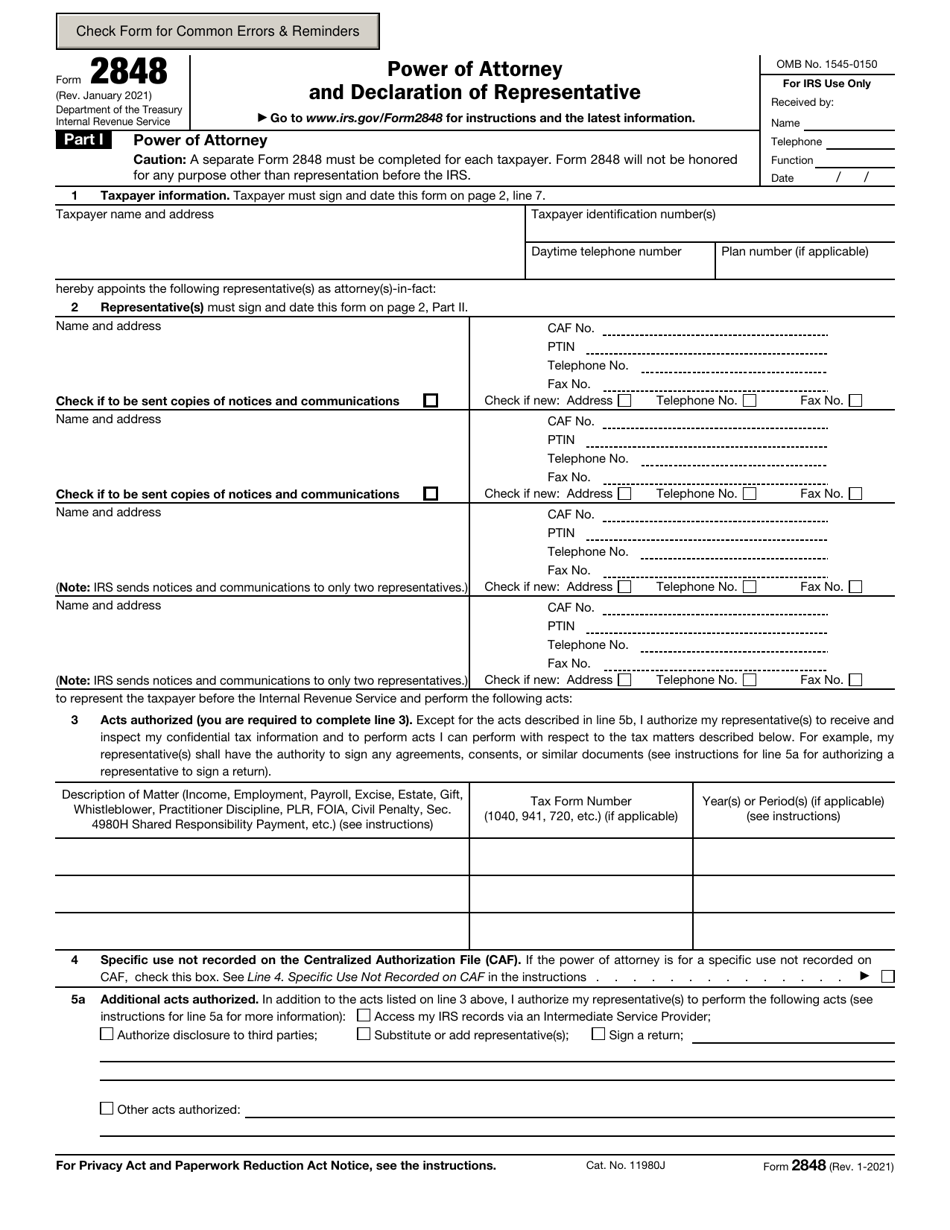

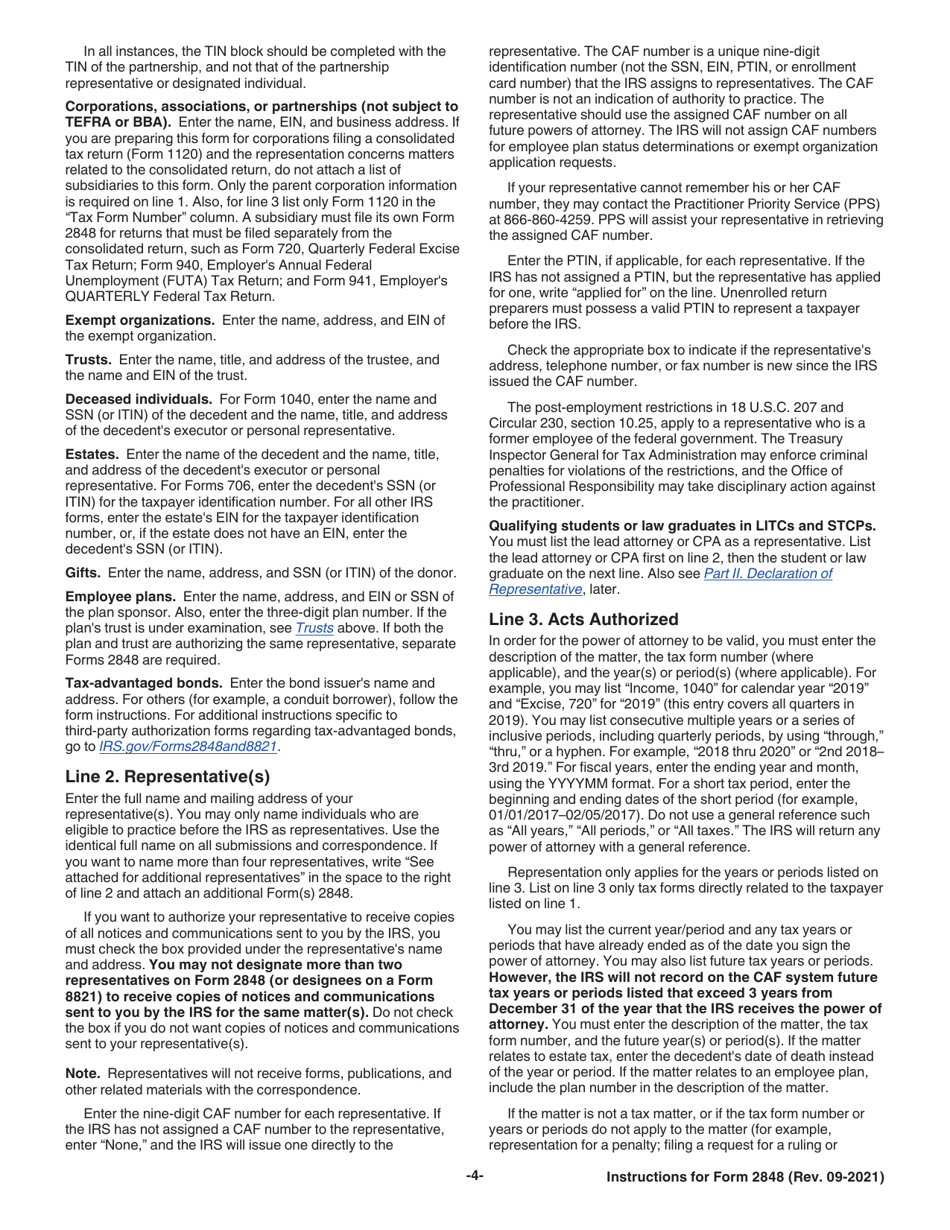

Part I Power Of Attorney.

Images References :

Source: www.zrivo.com

Source: www.zrivo.com

Form 2848 Instructions 2023 2024, February 2020) power of attorney and declaration of representative. Part i power of attorney.

Source: pdf.wondershare.com

Source: pdf.wondershare.com

IRS Form 2848 Filling Instructions You Can’t Miss, Form 2848 is specifically used to authorize a representative to deal with the irs on a taxpayer's behalf. Navigate irs form 2848 with confidence.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Form 2848 Instructions, Form 2848, power of attorney and declaration of. Page last reviewed or updated:

Source: blanker.org

Source: blanker.org

IRS Form 2848. Power of Attorney and Declaration of Representative, Washington ― the internal revenue service announced today that almost 940,000 people across the nation have unclaimed refunds. Navigate irs form 2848 with confidence.

Source: forms.utpaqp.edu.pe

Source: forms.utpaqp.edu.pe

Irs Form 2848 Power Of Attorney Form 2848 Instructions Form example, A broad durable financial power of attorney typically intends to give your agent the ability to act on your behalf in just about any. Form 2848 allows taxpayers to name someone to represent them before the irs.

Source: attorney-faq.com

Source: attorney-faq.com

Who Is Eligible To Be On Irs Power Of Attorney Form 2848, Navigate irs form 2848 with confidence. What is the irs power of attorney?

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 2848 Power of Attorney and, A detailed guide for accountants and tax pros. January 2021) department of the treasury internal revenue service.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Form 2848 Instructions, If your parent is no longer competent and you are your parent’s power of. Form 2848, power of attorney and declaration of.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

IRS Form 2848 Instructions, Submit forms 2848 and 8821 online. Information about form 2848, power of attorney and declaration of representative, including recent updates, related.

:max_bytes(150000):strip_icc()/2848-f0c6a242a34340aa97b1dcfbe3a539d6.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Form 2848 Power of Attorney and Declaration of Representative Definition, Form 2848, power of attorney and declaration of. An employer may continue to authorize an individual to represent them for wotc purposes using irs form 2848 until may 31, 2024.

Forms 2848 Power Of Attorney And Declaration Of Representative Are Intended To Authorize The Internal Revenue Service (Irs) To Discuss A Taxpayer’s.

Form 2848 allows tax professionals, such as an attorney, cpa or enrolled agent, to represent clients before the irs as if they were the taxpayer.

A Separate Form 2848 Must Be Completed For Each Taxpayer.

While you can authorize immediate family members to act on your.