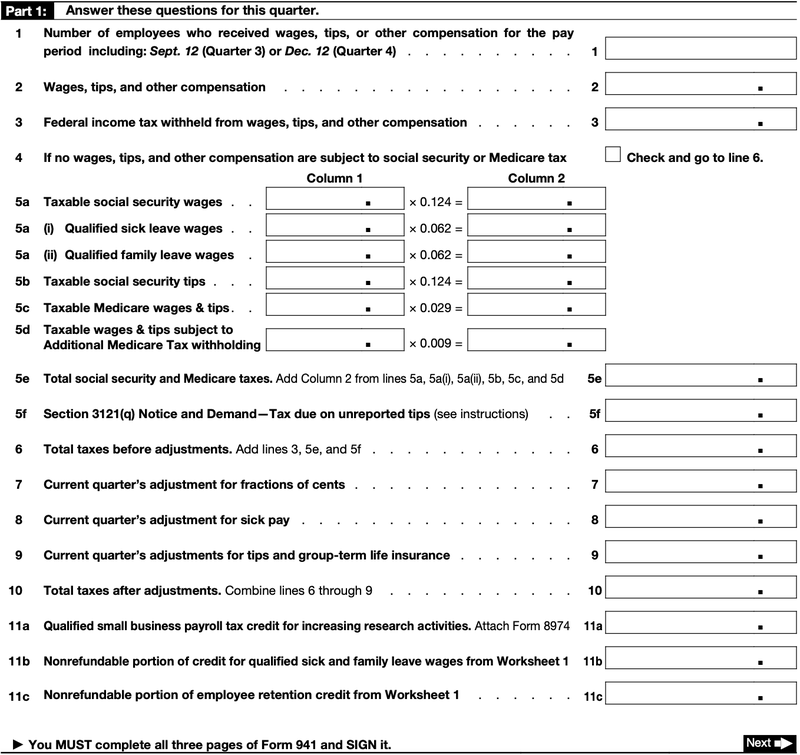

File Extension Taxes 2024 Form 941. Where to file your taxes for form 941. Most businesses must report and file tax returns quarterly using the irs form 941.

Employers report income tax withholding and fica taxes for the first quarter of 2024 (form 941), if they deposited on time, and fully paid, all of the. Form 941 is a quarterly form with a deadline typically on the last day of the month, following the completion of the previous quarter.

Head Over To The Irs Free File Site.

If you request an extension with the irs, you'll have until oct.

The Irs Form 941, Commonly Known As The Employer's Quarterly Federal Tax Return, Plays A Pivotal Role For Employers In Reporting Withheld Taxes From.

The 941 deadlines for the 2024 tax year are as follows:

Form 941 Is Filed Quarterly.

Images References :

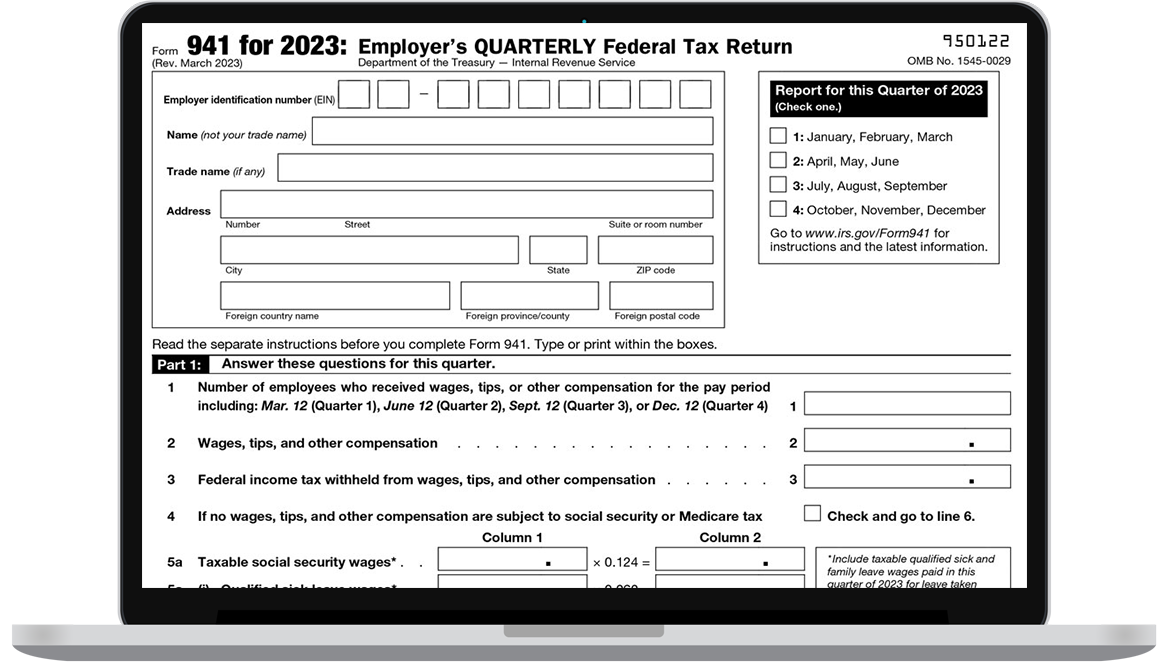

Source: online-941-form.com

Source: online-941-form.com

IRS Form 941 2024 Fill & Edit Printable PDF Forms Online, Here are the due dates for each quarter: From there, you can electronically request an extension that automatically extends your filing date until oct.

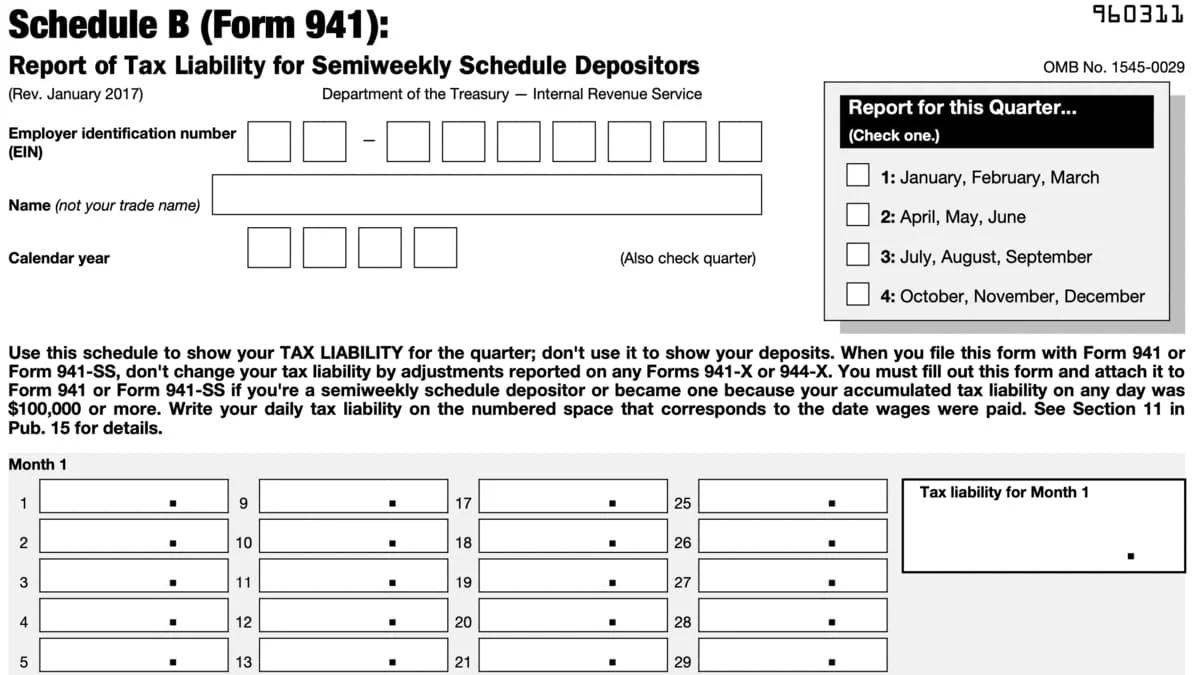

Source: www.taxuni.com

Source: www.taxuni.com

Form 941 Schedule B 2024 941 Forms TaxUni, You can request a tax extension by filing irs form 4868, application for automatic extension of time to file u.s. Find mailing addresses by state and date for form 941.

Source: kooqbirgitta.pages.dev

Source: kooqbirgitta.pages.dev

File Taxes Extension 2024 Agna Lorain, Irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as. From there, you can electronically request an extension that automatically extends your filing date until oct.

Source: 941.tax

Source: 941.tax

File 941 tax form online for 2023 Efile IRS 941 tax form, 15, 2024 to file your return. New changes to the form 941 for the 2024 tax year.

Source: 941.tax

Source: 941.tax

File 941 tax form online for 2023 Efile IRS 941 tax form, Form 941 for the 2024 tax year is the employer’s quarterly federal tax return that employers use to report income taxes, social security tax, and medicare taxes withheld. Employers engaged in a trade or business who pay compensation form 9465.

Source: lisaqchristie.pages.dev

Source: lisaqchristie.pages.dev

941 Form 2024 Pdf Mufi Tabina, Form 941 is filed quarterly. Filing this form gives you until october 15 to file a return.

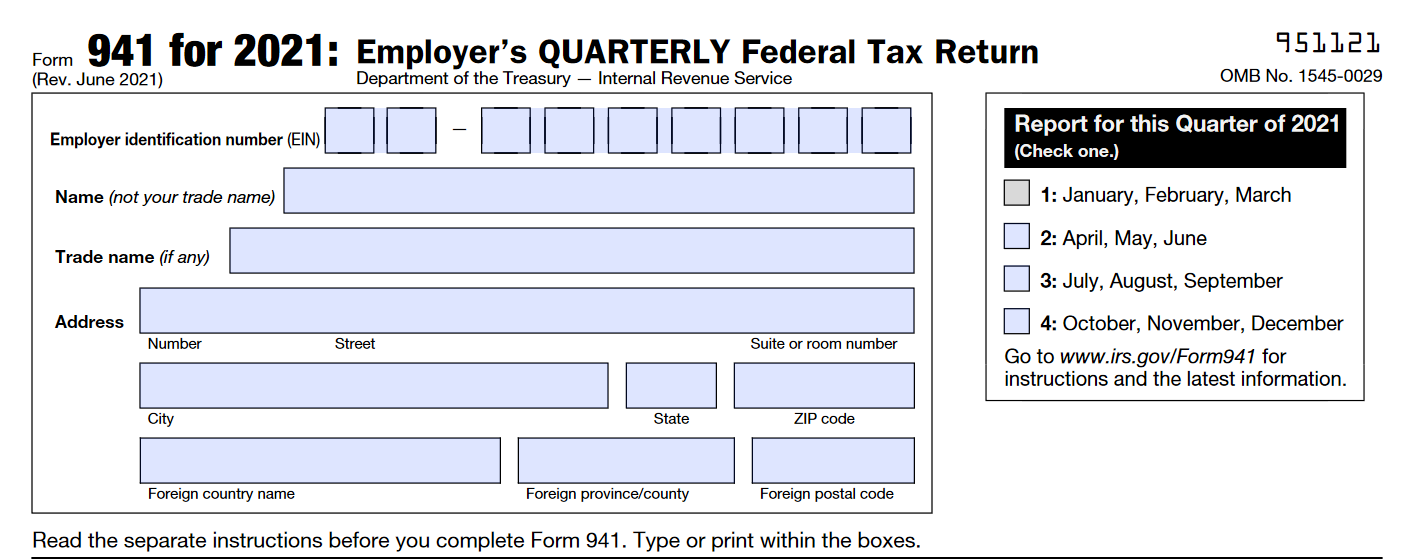

Source: printableformsfree.com

Source: printableformsfree.com

Irs Form 941 Instructions For 2021 Printable Forms Free Online, 15 — an additional six months — to file. The irs has released changes to form 941 for.

Source: www.fool.com

Source: www.fool.com

How to Prepare and File IRS Forms 940 and 941 The Blueprint, Here are the due dates for each quarter: If you request an extension with the irs, you'll have until oct.

Source: www.dochub.com

Source: www.dochub.com

Form 941 pr Fill out & sign online DocHub, Employers engaged in a trade or business who pay compensation form 9465. The irs also levies a fine if you don't file or ask for an extension by april 15.

Source: www.fool.com

Source: www.fool.com

How to File a Business Tax Extension in 2024, 15, 2024 to file your return. To electronically request an extension.

If October 15 Falls On A.

You must file your request by the april tax filing due date to get the.

What's The New Deadline To File Taxes If I Get An Extension?

15 — an additional six months — to file.